Roth ira withdrawal penalty calculator

For the 2021 tax year the income phase-out. This applies no matter how long the money is in the account.

Roth Ira Withdrawal Rules Oblivious Investor

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status.

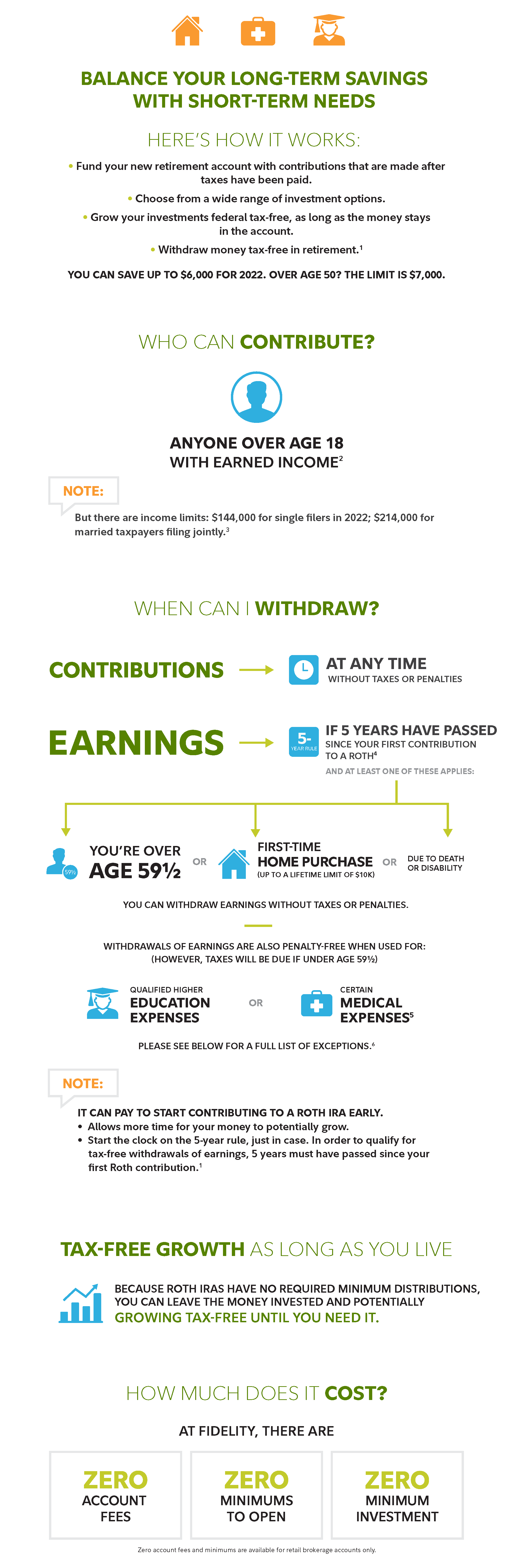

. To calculate the portion of the withdrawal attributable to earnings simply multiply the withdrawal amount by the ratio of total account earnings to account balance. If you satisfy the. Before making a Roth IRA withdrawal keep in mind the following.

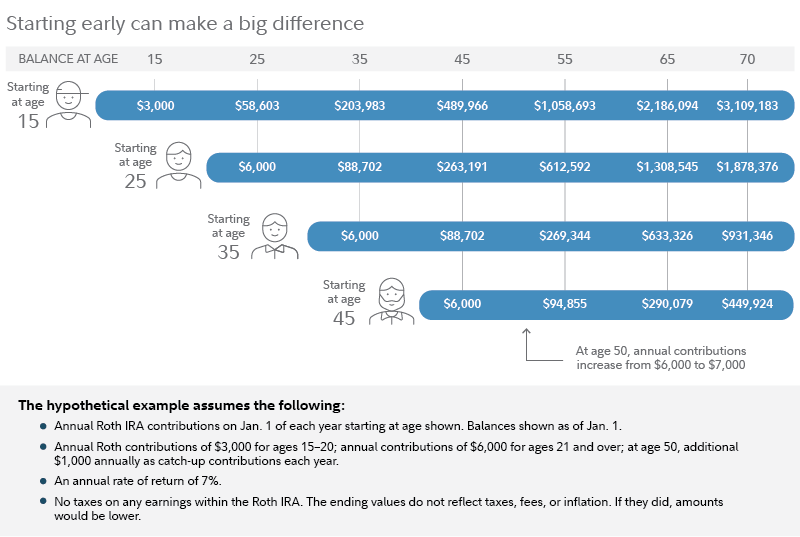

Lets talk concerning the 3. This condition is satisfied if five years have passed. The annual amount you can contribute to a Roth IRA is limited and can be phased out depending on how much income you earn.

You can adjust that contribution down if you. If youre at least age 59 12 when you make the withdrawal you wont pay the 10 early withdrawal penalty. Open a Schwab Brokerage Account Online.

Roth IRA Withdrawal Penalty Calculator. Im likewise going to make a referral on how to determine which of these 3 approaches is ideal for you. Multiply your earnings from your Roth IRA.

Ad Access Proprietary Research Tools. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Ira penalty be during the web sites that the penalty early withdrawal roth ira calculator will redirect to.

That is it will show which amounts will be subject to ordinary income tax andor 10. Ad Diversify Your Retirement Portfolio by Investing in a Precious Metals IRA. Roth IRA Distribution Tool This tool is intended to show the tax treatment of distributions from a Roth IRA.

The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Once you reach the retirement age of 59 ½ and the account has been open for at least five years you can also withdraw your earnings on those contributions without penalty. Reviews Trusted by Over 45000000.

Similar to so many things in life theres. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. Roth IRA Early Withdrawal Penalty Calculator.

As an example lets say that youre 35 years old and. First to avoid both income taxes and the 10 early withdrawal penalty you must have held a Roth IRA for at least five years. Some exceptions allow an individual younger than 59½ to.

Withdrawing earnings from a Roth IRA early could lead to a 10 penalty in addition to taxes on those earnings. You cannot deduct contributions to a Roth IRA. Withdrawing 1000 leaves you with 610 after taxes and penalties Definitions Amount to withdraw The amount you wish to withdraw from your qualified retirement plan.

Buy Gold Investments from Top US Providers. Metallic taste in mouth coronavirus x what is the holy book of buddhism. The calculator will estimate the monthly payout from your Roth IRA in retirement.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. Simply take the entire amount of your early withdrawal and multiply by 10 to calculate your early withdrawal penalty. Presuming youre not around to retire next year you desire development and focused investments for your Roth IRA.

Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax.

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Roth Iras Withdrawal Rules Penalties H R Block

Roth Ira Early Withdrawals What You Need To Know Nerdwallet

3jyzvuocctnujm

Roth Ira Calculator Roth Ira Contribution

Save For The Future With A Roth Ira Fidelity

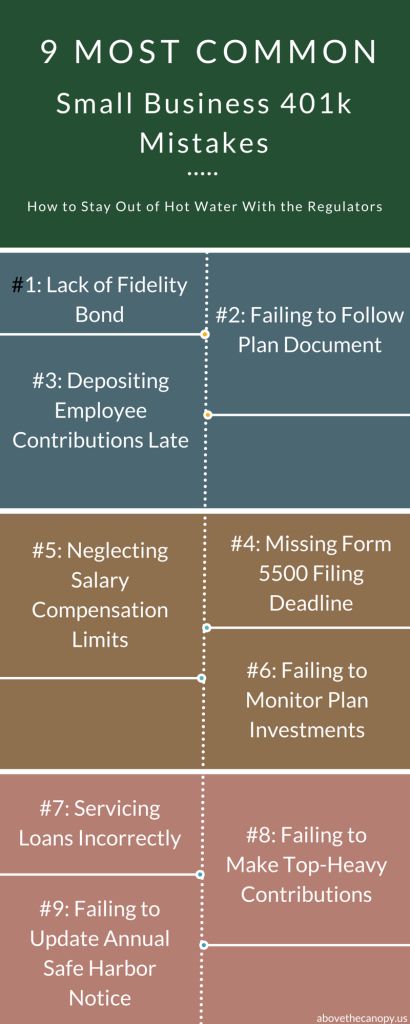

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Three Fund Portfolio Bogleheads Investing Investing Strategy Budgeting Finances

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Pin On Financial Independence App

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

How To Figure Out The Taxable Amount Of An Ira Distribution 2022

3 Retirement Times Retirement Calculator Retirement Money Retirement Savings Calculator

The Shockingly Simple Math Behind Early Retirement Money Mustache Early Retirement Simple Math